Optimize Your Compliance Analytics for Annual SOX Audits

Contents

Established in 2002 and the wake of high-profile corporate scandals throughout the 90s, the Sarbanes Oxley Act (SOX) was designed to bolster corporate accountability and responsibility.

It applies to every publicly traded company in the US, and all corporations must verify their compliance annually through documentation and audits. Most organizations can streamline their day-to-day business activities with powerful compliance analytics tools that make it easier when preparing for an annual audit. This benefits all your partners, including external auditors.

What is a Sarbanes Oxley Compliance Audit?

The annual SOX audit follows a highly structured and rigid approach. It’s a multi-phased process that verifies the accuracy and adequacy (or inaccuracy and inadequacy) of your organization’s financial documentation. It also ensures that top executives are aware of documentation and controls to ensure accuracy.

The audits are performed by independent auditors, and there are stipulations in place to guarantee that the auditors themselves are acting honestly and fairly.

Recordkeeping in the Information Age

Since most organizations nowadays keep the bulk of their business records in a digital format, the SOX Act is primarily focused on digital records. And as such, several specific SOX controls are required to safeguard these records, which are examined during a standard SOX audit.

Focus on the following areas when optimizing your compliance analytics:

- Internal safeguards, controls, and policies – These controls drive the physical and virtual security controls and safeguards of your organization.

- Network security – Protecting your network from external hackers and other threats is a crucial step in achieving and maintaining SOX compliance.

- Database security – Since the SOX Act is primarily focused on ensuring data integrity, it’s essential that your databases are protected from inappropriate access—and changes.

- Login security – Examining user login activities can help spot suspicious events and failed login attempts, thus alerting you to potential cyberattacks.

- Account and user security – Hackers and other malicious actors often target individual users for their login credentials, as this is often easier than many of their other methods.

- Information accessibility – While your data needs to remain secure at all times, it also needs to be readily available and easily accessible by those with the right permissions.

Beyond these general controls, which apply to overall information security, Section 802 of the SOX Act establishes specific, enforceable rules pertaining specifically to recordkeeping:

- Electronic records destruction and falsification – If records are disposed of or falsified in any way, top executives can face significant fines and up to 20 years imprisonment.

- Auditors who violate these requirements may face up to 10 years imprisonment.

- Electronic records retention – Any information that’s included in an annual SOX audit must be kept for a period of seven years after the conclusion of each audit or review.

The stakes of SOX compliance are extremely high. Executives can no longer use ignorance as an excuse for inaccurate recordkeeping, and the Act stipulates that they’re personally responsible.

Adjusting your analytics for SOX Compliance

Now that you have a better idea of what auditors are looking for, it’s time to adjust your compliance analytics to better match the rules and requirements of the SOX Act. This makes it easier to pass the next audit while streamlining day-to-day operations on behalf of analytics staff.

The following are best practices for streamlined compliance analytics:

Analyzing entire data populations

Meant to replace traditional data sampling, data populations provide valuable insight without all the overhead. Instead of looking at specific data on a case-by-basis, the population analysis gives you a broader array of results. Plus, it still meets the requirements of today’s SOX audits.

You’ll see numerous advantages when analyzing entire data populations, including:

- Clear and concise risk assessment – Quickly identify, classify, and mitigate the top risks facing your organization. Organize risks by reaching across all data sources and locations.

- Greater data reliability – Maximize data integrity and accuracy across the board by centralizing your visibility of changes. Approve, deny, or track changes from one place.

- The ability to easily identify exceptions and outliers – Spot records and accounts that fall outside the normal spectrum and keep track of them in light of all other assets.

Collectively, these lighten the resource load for your internal staff and external auditors alike.

Adapting to Common SOX Audit Difficulties

In the past, issues like duplicate payments could only be spotted with a highly trained and diligent eye. But with modern and next-gen analytics software, such anomalies and errors that could ruin an audit are easily identified and remediated through automated rules and actions.

Compliance analytics tools also remedy issues arising from ticky-tack elements of the SOX Act.

For example, SOX requires different individuals to post and approve journal entries. These records would have to be manually verified by an auditor in past audits. With modern analytics software, electronic signatures—and identities of signatories—are automatically verified.

Eliminating issues like this prior to your annual SOX audit will help ensure a successful report when the time comes.

Classifying Documentation and Compliance Risks

If possible, try to take a risk-based approach to your organization’s SOX compliance analytics. At the very minimum, you should use two different categories to classify and segment risks:

- Medium- and low-risk areas

- High-risk areas

Separating risks into one of these two categories helps your team prioritize and delegate them effectively. Then, if necessary, you can further separate the very lowest-risk areas into a third category.

While all risks need to be addressed, most organizations should prioritize remediation efforts from highest to lowest, eliminating the biggest threats before moving on to smaller ones.

Viewing the Numbers From Different Perspectives

It’s also useful to view your compliance analytics from the perspective of other parties and partners. This helps you gain valuable insight into their motivation, reasoning, and attitudes.

External auditors, for example, have a primary goal of achieving and maintaining audit quality. This meets both their obligation to their employer as well as their responsibility to you. In some cases, external auditors also have a secondary goal of providing you with relevant and valuable business insights.

By keeping their point-of-view in mind and that of others involved, you’ll be able to create a highly cooperative and amiable compliance process.

Utilizing third-party managed services

Plenty of third-party managed services are available to further optimize your compliance analytics while filling any gaps in internal processes. Some of the best approaches include:

- Robotic process automation – AI-driven software can mimic interactions between IT systems and human users, creating lift for over-burdened developer teams.

- Continuous controls monitoring – Real-time tracking of financial transactions enables swift, accurate decision-making across risk management and compliance programs.

- Network monitoring and testing – Consistent network monitoring and testing is critical when protecting your network (and the data within) from hacks and other cyberattacks.

Outsourcing some of your compliance obligations is a great way to divert organizational resources and reduce the strain on your own staff members.

How QUBEdocs helps you

With the support of QUBEdocs, you’ll find it easier to quantify productivity, improve organizational visibility, and maintain compliance with the current applicable standards, including the SOX Act.

Maintaining effective enterprise-wide documentation procedures requires automated solutions that eliminate the element of the unknown when your SOX audit comes and your financial model data is examined.

QUBEdocs software will:

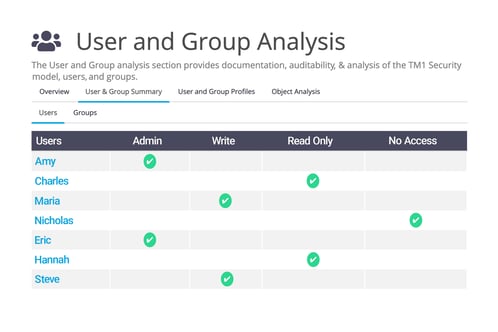

- Make all your cubes easily searchable to ensure auditors can navigate your entire TM1 system and find every piece of required information

- Provide a solution to adding key elements to your user log data – revealing crucial information on who did what and when

- Seamlessly automate all of your essential model change documentation

QUBEdocs offers a complimentary pre-audit health check so you can find out which gaps your organization must cover before your next SOX audit, and how these solutions will help your risk mitigation year-round.

Request a complimentary pre-audit health check now

Sources:

Deloitte. SOX compliance: A smarter way forward. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/risk/us-sox-compliance-smarter-way-forward.pdf

FERF. Data Analytics and Financial Compliance: How Technology is Changing Audit and Business Systems. http://www.financialexecutives.org/ferf/download/2016%20final/2016-012.pdf

Galvanize. Making SOX compliance easier for everyone. https://www.wegalvanize.com/assets/ebook-making-sox-compliance-easier.pdf

Investopedia. Sarbanes-Oxley (SOX) Act of 2002. https://www.investopedia.com/terms/s/sarbanesoxleyact.asp

Sarbanes-Oxley 101. Sarbanes Oxley Audit Requirements. https://www.sarbanes-oxley-101.com/sarbanes-oxley-audits.htm

Sarbanes-Oxley 101. SOX Section 802: Criminal Penalties for Altering Documents.

https://www.sarbanes-oxley-101.com/SOX-802.htm

U.S. Securities and Exchange Commission. Final Rule: Retention of Records Relevant to Audits and Reviews. https://www.sec.gov/rules/final/33-8180.htm