The Sarbanes-Oxley Act (SOX) is a powerful piece of legislation that can strike fear in the hearts of even the most risk-averse and process-driven organizations. While SOX can seem heavy-handed, the law is designed to protect the investors of public companies by ensuring corporate responsibility and transparency of financial reporting and documentation.

And if your organization has financial or accounting data in a TM1/Planning Analytics environment, you need to be extra diligent. Because without SOX compliance, companies can be fined, or even worse, delisted from the stock exchange.

More than just a slap on the wrist

Not meeting SOX requirements can result in a very bad day at the office. Fines in the millions of dollars have been issued in the past, which upsets influential shareholders and has caused countless job losses. But an organization that receives only a fine can consider itself lucky.

Certain cases of non-compliance can result in a company being removed from listings on public stock exchanges. And in severe cases of mismanagement, officers of the company can face criminal penalties with prison terms of up to 20 years. Interestingly, one part of the legislation surrounds the intention of any wrongdoing. Even if non-compliance is entirely accidental, fines can still be given, and jail sentences can still get handed out. According to SOX, ignorance is no excuse.

What can be done about it?

As with every piece of compliance, your organization should be proactive rather than reactive. That means you’ll be fully prepared when it’s time for auditors to investigate your corporation’s financial documentation.

5 ways to help your organization comply with SOX regulations

1. Implement a control framework

It’s not enough to assume your financial data is accurate. Your organization must implement adequate controls to safeguard financial data to ensure accuracy and trustworthiness. Your framework should make it easy for a SOX auditor to review rules, policies, and procedures so they can spend less time searching, and more time giving your organization a big tick for compliance.

2. Provide as much data as possible

Log collection and monitoring systems must provide an audit trail of all access and activity to sensitive business information. The more information you provide, the better an auditor can understand the way your company operates. If you can’t supply the specific data on request, the repercussions for your organization could be costly in more ways than one.

3. Make it easy for auditors

SOX auditors are entirely independent and won’t have been involved in the design or implementation of your financial systems. If your TM1/Planning Analytics environment can only be navigated and understood by the developers who built it, your corporation is in trouble. Like every other part of business, time is money to an auditor. And if they’re unable to easily access, find, and read the information they require, the auditing process could stretch into weeks, if not months.

4. Automate, automate, automate

Automation is your best friend when it comes to protecting shareholders from errors and fraudulent activity within your financial documentation. SOX compliance mandates a closed system that tracks changes to your financial records, which is why an automated solution is so powerful. Automating your processes also removes human influence and the chance for employee-based interference, making your data more trustworthy and accurate. Plus, automation speeds up the entire process, so you save time and resources.

5. Comprehensive data security

SOX requires formal data security policies, communication of data security policies, and consistent enforcement of data security policies. If your company hasn’t developed and implemented a comprehensive data security strategy, this should be your number one priority.

What more can you do?

To provide unparalleled visibility and access to your financial planning data and TM1/Planning Analytics environment, consider implementing QUBEdocs. You’ll not only speed up the auditing process, but you’ll also have peace of mind knowing AI and automation is helping to keep everything above board.

QUBEdocs gives your organization:

A complete picture

With QUBEdocs, SOX auditors can see more of your environment than ever before. Now they’ll have detail and context around what’s changed, who’s making the changes, and when it happened. Thanks to our powerful search capabilities, auditors can uncover pertinent information with the click of a button.

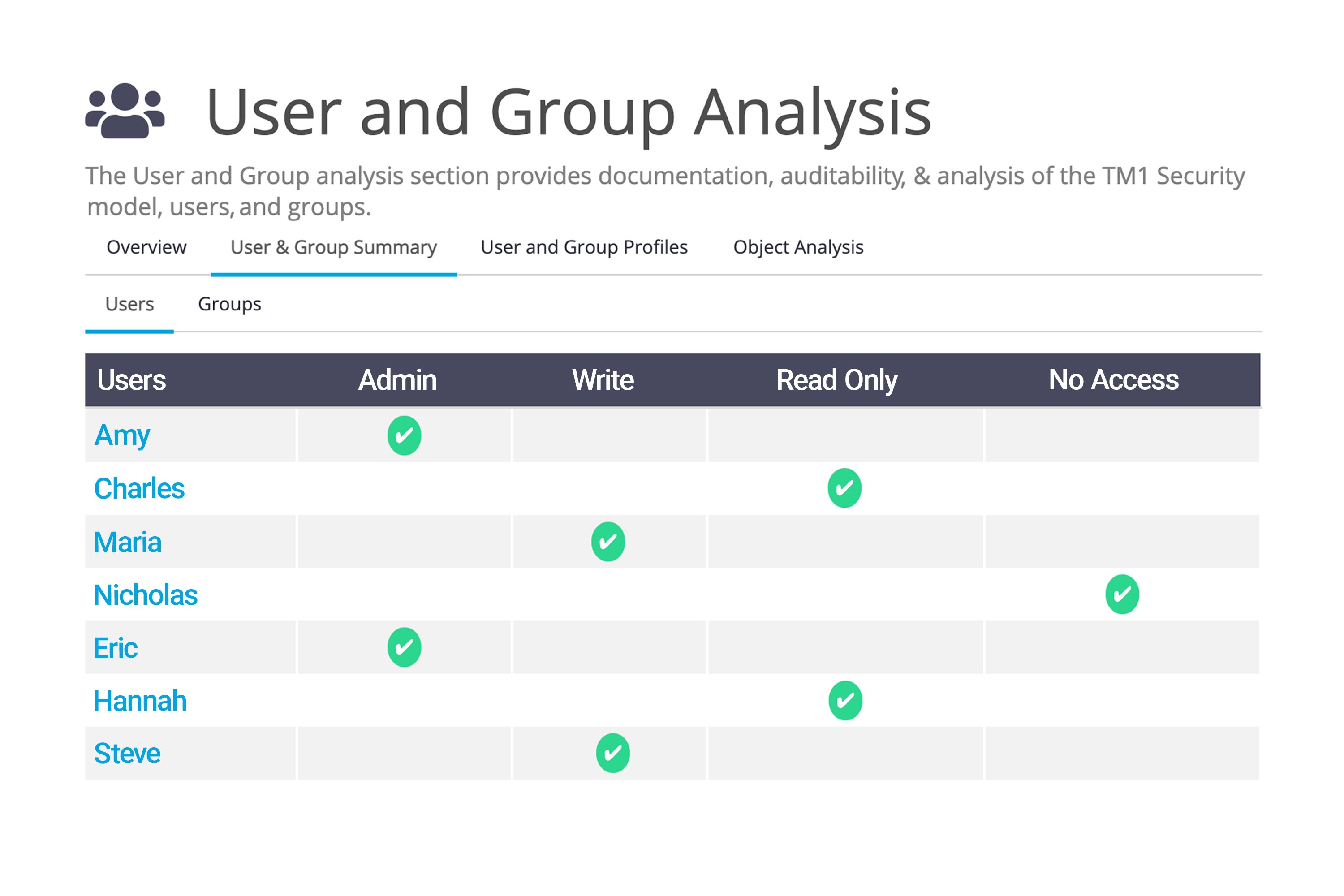

A comprehensive view of user interactions

Your financial models are accessible to a number of employees within your organization. That’s why it’s essential to record users and see who’s performing which actions and when they take place. QUBEdocs allows auditors to search users by name, see who’s made changes to a process, rule, or object, and view the permissions of each user.

Next level reporting tools

QUBEdocs’ reporting collates and identifies critical information within your TM1/Planning Analytics environment. Auditors can export this information into Excel to group, display, and refine the data as they see fit.

The ability for auditors to:

-

Quickly make a report that shows who has access to the environment

-

Produce lists of when users perform actions like reading, writing, and deleting

-

Create overviews that outline changes to processes, rules, and objects

Talk to us today

Please don't hesitate to get in touch if you'd like to understand how QUBEdocs can help the audit process run more smoothly. Now you can preempt the entire process and make lengthy, and costly SOX audits a thing of the past.